The quantum supply chain is currently in a nascent stage, characterized by high demand for advanced products that necessitate extensive R&D, leading to elongated lead times that impede progress. While quantum computing has the potential to revolutionize how such things as supply chain are managed, its own supply chain is still filled with uncertainty. The market is marked by a small volume of highly specialized quantum products, which faces a ”valley of death” without adequate government subsidies and support.

Traditional industries are entering the quantum domain through investments in quantum computing, sensing, and communications technologies. Their entry is shaping the quantum supply chain by integrating conventional manufacturing prowess with quantum innovation.

Stakeholders can position themselves by investing in R&D, forming strategic alliances, and adopting a multi-sourcing strategy to mitigate risks associated with the quantum supply chain. Emphasizing collaboration, both within and across borders, is crucial to building a robust quantum ecosystem.

There is a driving need for policymakers, investors, and vendors to better understand the very complex quantum supply chain. Policymakers need to make strategic decisions that can spark progress. Investors want to look out for the next big leap. And vendors need to best understand customer requirements, competitions, and other factors efforts to connect, support, and streamline the chaos of innovation into the clarity of solutions.

Global quantum supply chain report

To provide answers for this diverse audience, Global Quantum Intelligence (GQI) created an in-depth market study and report of the Global Quantum Supply Chain. We identified 744 suppliers located in 36 different countries supplying 60 different types of components, grouping them into categories such as photonics, electronics, cryogenics, mechanics, and several other areas.

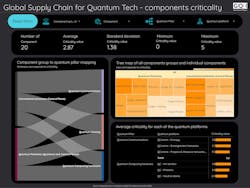

As part of the study, we also interviewed several purchasers of these components to identify significant macro trends and challenges they face in obtaining a stable supply for their needs. To help our users gain a better understanding of this ecosystem, we created a framework that can help classify the components in several dimensions—including quantum pillar (computing, communication, or sensing), quantum platform (e.g., superconducting, ion trap, photonics, etc.), criticality, country of origin, size of company, and supply chain value.

To make this information available to our customers, we provide a full report on the supply chain as well as an interactive, dynamic display that allows a customer to filter and organize the data to serve their needs. Sample screen shots of the dynamic displays are shown throughout.

General observations

Here are some of the key findings we found in our research relevant to all segments of the quantum supply chain and discussed in the report:

1. Lead times are a critical bottleneck due to the surge in demand for high-end quantum products, necessitating a multi-sourcing strategy.

2. The quantum sector is grappling with the “small volume problem,” requiring government intervention and subsidies to traverse the “valley of death.”

3. For quantum technologies to thrive, funding distribution must be balanced across the ecosystem, recognizing the dependencies of software and hardware.

4. The Western quantum supply chain exhibits strength and resilience, with countries specializing in niche areas and fostering regional ecosystems.

5. The supply chain is diverse, encompassing both established corporations and burgeoning startups, each contributing unique value.

6. Standardization and consolidation are imperative to streamline operations and ensure compatibility across the quantum supply chain.

7. The industry has yet to reach the era of scaling and commercialization, indicating that the current focus remains on development and prototyping.

Key developments to watch

The quantum supply chain, like the rest of the quantum industry, is very dynamic with new offerings and vendors being introduced every week. GQI is keeping a close eye on what is happening and the list below shows some of the key developments to watch:

1. The timeline for scaling and commercialization of quantum computing, sensing, and communications technologies remains uncertain.

2. Potential shortages of crucial elements like Helium-3 could create supply constraints, impacting the progress of superconducting qubits.

3. Governmental roles in providing funding subsidies and allocating critical resources for quantum development are yet to be fully realized.

4. International cooperation vs. national-centric approaches in quantum development will shape the future landscape of quantum technology.

5. The establishment and adoption of standards for quantum technology are still in the formative stages, with significant advancements required.

Photonic components

In addition, when we look specifically at photonics components we can make some additional comments. Photonics splits into two categories: Conventional Photonics, focusing on lasers (UV, visible light, SWIR) and related equipment, and Quantum Photonics, which emphasizes single-photon sources, detectors, and their associated gear.

Across these categories, there are 20 component types relevant to quantum technology. Their criticality varies widely, with an average level deemed medium, but with a range from 0 to 5—indicating components that range from easily replaceable or abundantly available to those irreplaceable without significant detriment to development.

The Sankey chart analysis reveals that both Conventional and Quantum Photonics hold comparable importance across the three main areas of quantum technology, with a similar criticality distribution. Quantum Communications is highlighted as the most photonics-dependent area, though Quantum Sensing and Computing also significantly rely on photonics technologies.

Geographically, the United States stands out as a major photonics hub, with Germany, specifically the Berlin region, also noted for its well-developed photonics ecosystem. In Asia, Japan and South Korea are recognized as key players in the field.

These findings and developments paint a picture of a quantum supply chain that is ripe with potential, yet faces significant hurdles that must be addressed through strategic planning, collaboration, and policy support. The full report spans 50 pages and provides an in-depth look at what is happening in this complex quantum supply chain. To learn more, you can visit the GQI website at https://global-qi.com.