FINLAY COLVILLE

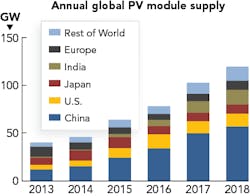

Installations of solar photovoltaic (PV) panels are forecast to reach 120 gigawatts (GW) during 2018, compared to 100 GW installed during 2017. This double-digit growth epitomizes an industry that is going through a seemingly unstoppable phase of unopposed end-market acceptance, stimulating upstream technology innovation change at unprecedented rates (FIGURE 1).

Growth metrics in the solar PV industry are not simply measured by way of end-market panel deployment. They are also measured at the component manufacturing stages, with cell and module producers being forced to increase investments into research and development (R&D) and technology upgrade processes just to remain competitive.

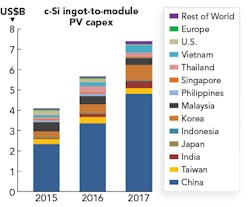

Capital expenditure (capex) for the midstream segment of the value chain (covering ingot, wafer, cell, and module manufacturing) reached $8 billion in 2017—more than double the investments seen back in 2014, with 2018 expected to be a fifth consecutive year of capex growth (FIGURE 2).Alongside these growth metrics, however, the PV industry is constantly having to adjust its upstream (manufacturing) and downstream (module shipment and installation) tactics and strategies to adapt to a rapidly changing and uncertain global trade landscape that constantly seeks to impose import barriers based on manufacturing country of origin.

This article reviews recent developments in PV manufacturing and technology, discusses the impact on cell and module manufacturers, and highlights the key issues for capital equipment suppliers seeking to benefit from the current round of capacity expansions and technology upgrades.

Specific attention is afforded to laser-based equipment, which remains one of the major beneficiaries of an industry-wide upgrade cycle that is well underway, arising from the necessary addition of passivation layers deposited on the rear side of solar cells. Indeed, this process flow change has even morphed into module product-line nomenclature, simply abbreviated to PERC (passivated emitter rear cell). The PERC revolution in solar cell manufacturing has created the most dynamic and meaningful application for lasers yet seen within the industry.

China drives solar growth

The growth in solar PV deployment since 2012 has greatly exceeded forecasts. The general consensus a few years ago was that annual deployment of solar PV would hit the 100 GW level during the 2020-2025 period. In reality, this occurred in 2017, providing the first key indicator that solar was finally emerging from a policy-subsidized market to a supply-driven solution to meet the growing global appetite for renewable energy contributions within the overall energy supply mix.

Underpinning this transformation has been the changing role of China, for both component manufacturing and end-market system deployment. This is most evident when reviewing market activity during 2017, when Chinese-owned companies produced more than 80% of the polysilicon, wafers, cells, and modules that served the 100 GW of systems installed during the year.

The signs have been abundantly clear over the past decade that PV manufacturing dominance was a key motivation for Chinese banks being given the go-ahead to release funds to its domestic sector. However, what was not foreseen was the explosive growth in module deployment within the country, moving from 12 GW in 2013 to a projected 60 GW in 2018, and accounting for about half of all end-market solar installations during 2017-2018. FIGURE 1 confirms the role of China in global market growth since 2013.

Currently, there are no signs that China plans to slow down solar industry investments. Indeed, the government is now seeking to stimulate the domestic manufacturing segment even further, in an attempt to become not simply a low-cost producer of high-volume components, but to match this with technology leadership by having the highest-efficiency solar cells being produced.

While commentary on this Chinese ecosystem provides much of the impetus today for component manufacturing, capex, and equipment supply, solar PV is rapidly gaining widespread acceptance from institutional investors whose due diligence is based purely on return-on-investment at minimal risk. This is driving record levels of investments to install new solar parks globally and, within the burgeoning secondary market, by companies that are mandated to add renewable energy assets to diversified long-term portfolios.

Silicon continues to dominate manufacturing

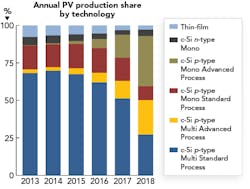

The use of crystalline silicon (c-Si) wafers for solar cell production continues to meet more than 95% of global end-market supply, with only two prominent companies left pursuing thin-film based technologies—First Solar (Tempe, AZ) using cadmium telluride (CdTe) and Solar Frontier (Tokyo, Japan) with copper indium gallium selenide (CIGS). FIGURE 3 shows market share contributions from c-Si variants and thin-film production.Indeed, as the solar industry has moved from a 50 GW market in 2014 to 100 GW in 2017, the scale of c-Si production in China, from its collective base of manufacturers, has firmly set the benchmarks for production cost and selling prices. The only obstacle for the Chinese companies has been to address import barriers arising from trade cases imposed by the European Union and the U.S. Department of Commerce. Until the end of 2017, this was dealt with easily through use of capacity located in Southeast Asia (particularly Vietnam, Malaysia, and Thailand), either as direct company operations or by using a third-party supply of modules.

Top-10 PV module suppliers in 2017

Ranking | Producer |

1 | JinkoSolar |

2 | Trina Solar |

3 | Canadian Solar |

4 | JA Solar |

5 | Hanwha Q-CELLS |

6 | GCL-SI |

7 | LONGi Solar |

8 | Risen Energy |

9 | Shunfeng (incl. Suntech) |

10 | Yingli Green |

FIGURE 4. The top-10 module suppliers (by shipment volume) to the PV industry in 2017 included nine companies headquartered in China, with Hanwha Q-CELLS being the exception (Korea operations); the top-10 companies supplied almost 60% of PV modules in 2017.

The dominance of Chinese c-Si producers can be seen clearly in FIGURE 4, looking at the top 10 module suppliers to the PV industry during 2017. Nine of the companies are Chinese-headquartered, with Hanwha Q-CELLS the only non-Chinese company. Hanwha Q-CELLS has its main operations now in South Korea, with multi-gigawatt cell and module facilities also in China and Malaysia.

Just a few years ago, having module shipments at the gigawatt level was sufficient to be an industry leader. Now, however, the top module suppliers (in particular, JinkoSolar and Trina Solar) are shipping up to 10 GW annually, with cell and module capacity levels well above 5 GW located across China and Southeast Asia.

In the near-term, it is highly likely this domination will continue. As long as China is accounting for about half of module supply to the PV industry, Chinese-based producers (that exclusively supply the domestic China market) will have a baseline of supply that is not available to non-Chinese companies. This is allowing Chinese companies to have an economy-of-scale that sustains acceptable double-digit gross margins in production, almost regardless of the rate of decline of module pricing.

China wants to be a technology leader

With Chinese companies now dominating production metrics across the entire value chain, from polysilicon to module stages, the next target for the country is to show technology excellence. This drive started a few years ago, when minimum module efficiency levels were imposed as constraints for deployment to qualify for the Top Runner program implemented by the government.

This had an immediate effect on cell manufacturing that has seen most of the domestic cell producers implement process flow changes to increase cell efficiencies. It has also created a thriving opportunity for PV equipment suppliers to upgrade existing lines, in addition to the healthy order intake for the tool makers coming from new factories built in China and Southeast Asia.

Until the end of 2016, the PV industry—particularly China—was focused on p-type c-Si wafer use, as opposed to higher-specification n-type substrates that are the cornerstone of the semiconductor industry. The PV industry consumes about 95% of all silicon production.

Indeed, the technology focus in China, which led to the country’s dominance in production, was largely from using multi c-Si wafers produced by using slurry-based wire saws to slice silicon bricks grown in casting furnaces. This low barrier-to-entry route was a perfect fit for the Chinese companies, and led to p-type multi c-Si cell production having about 75% market share as the industry moved beyond the 50 GW annual deployment mark.

However, in the past couple of years, this has all changed. While the driver was in part coming from the domestic competition within China to have higher performance modules, the industry as a whole is now moving quickly to using p-type mono wafers, where the ingots are produced using Czochralski-based pullers and sawed into wafers using diamond wires.

The use of mono c-Si wafers had always been a motivation for solar cell producers to push average efficiency levels of cells above 20%. However, the lack of any major supplier for mono wafers had previously hindered any market-share gains against p-type multi wafers.

The catalyst for change has come from the highly ambitious and successful strategy of just one company based in China—Xi’an LONGi Silicon Materials (branded as LONGi Solar; Shanghai, China). This company set out a clear plan years ago to become a multi-gigawatt, low-cost supplier of mono c-Si wafers—something that had never been done before. By the end of 2017, LONGi Solar had accumulated 15 GW of mono ingot pulling and diamond-wire wafering in China, and now plans to add about 10 GW per year for the next three years, to reach 45 GW of mono wafer capacity at the end of 2020.

More recently, another Chinese-based company—Tianjin Zhonghuan Semiconductor (or Zhonghuan) —has joined LONGi Solar in having mono capacity levels measured in the tens of gigawatts. Collectively, these two companies have created the supply channel for p-type mono that has allowed cell manufacturers to make the shift from multi to mono, in the knowledge that wafer supply is available at cost-per-watt prices competitive with p-type multi wafer supply.

Consequently, the PV industry technology landscape is now going through a radical transition to mono c-Si, resulting in increases in module efficiencies (and panel powers) that are forcing every company to have high-efficiency cell lines in place. This shift from multi to mono is also accelerating the change in rear-side cell processing, where passivation layers are now being deposited as standard, replacing the legacy aluminum-based back-surface field approach that was the norm with screen-printing tools. This new cell architecture (simply known as PERC) has created the first major application for lasers in the PV industry.

Investments flow into n-type technologies

Going back 20 years in the PV industry, every roadmap was based upon technology finally moving from p- to n-type mono cell production. However, the economics did not stack up, and the challenges in producing 23–25% cells in mass production were beyond the capability of the entrants that currently dominate cell production with p-type capacity.

The use of n-type wafers allows performance levels above the best-in-class p-type variants, a fact demonstrated by the first two companies that succeeded in scaling gigawatt-level operations with n-type: SunPower (San Jose, CA) and Panasonic (Osaka, Japan; through inheriting the former Sanyo PV business in Japan).

The rapid price erosion of module average selling prices (ASPs) since 2012, resulting in module prices in the $0.30–0.40/watt range, has left SunPower and Panasonic with marginally profitable operations, and has somewhat consigned n-type to niche-offering status.

However, in its drive to show technology leadership, the Chinese government is now seeking to create a manufacturing base within China to push n-type capacity. The vehicle for this is coming from the creation of the Super Top Runner program with 1.5 GW of domestic module demand on offer to higher-performing modules that necessitate the use of n-type production.

With state backing in China, investments are now flowing into new capacity for n-type production and, in particular, heterojunction-based solar cells that had been the exclusive domain of Panasonic to date. The plan within China is to match the performance levels of Panasonic, but with much lower capex and operating costs, and using deposition equipment manufactured within China by Chinese-owned tool suppliers.

This new initiative remains highly ambitious and not without considerable risk, as most of the process know-how for n-type heterojunction resides with equipment suppliers outside China (and Panasonic), and almost all of the Chinese companies seeking to disrupt the industry have little, if any, previous experience producing solar cells.

However, the threat to p-type producers cannot be dismissed, even if just one of the new entrants manages to scale to the gigawatt level with n-type production. If this does happen in the next 2–3 years, and the technology is shown to be cost-effective in high volume, then it could be expected that many companies showing in the top-10 ranking list for 2017 will make the necessary adjustments to in-house cell capacity and add n-type production lines.

PERC: the first major application for lasers in PV

For laser-based equipment supporters following the PV industry in the past, there was no shortage of false alarms in terms of applications that could create strong revenue streams. The lack of success, however, left the laser industry somewhat disillusioned with the PV sector, with applications such as thin-film patterning, laser edge isolation, through-hole via drilling, and laser doping offering nothing but lumpy new-order-intake blips.

By the end of 2018, however, virtually every solar manufacturing line will have laser tools operating at key process flow stages. The major driver is coming from one application: PERC. However, it is also noteworthy to discuss briefly what is happening with thin-film solar manufacturing, as there is a mini-boom happening here as well.

Thin-film PV manufacturing that demands multiple laser tools being used in production lines can broadly be split into three categories: First Solar with its expansion plans; Solar Frontier fighting to retain profitable operations and seeing declines in production output; and another phase of Chinese optimism that has the hallmarks of one-off R&D spending to bolster the balance sheets of a handful of European equipment suppliers.

First Solar (as the only CdTe provider) is currently investing $1 billion over a 2- to 3-year period to replace its legacy 2–3 GW of Series 4 panels (600 × 1200 mm) with Series 6 panels (1230 × 2003 mm). Furthermore, the company is setting up additional capacity in Vietnam, complementing the main production site in Malaysia. Loyal to its equipment suppliers that have been instrumental to the success of Series 4, most of the original suppliers are contracted now to deliver the equipment for Series 6. This includes LPKF Laser & Electronics (Garbsen, Germany) for the laser-based patterning equipment, making the company the only laser-based tool supplier to truly benefit from the thin-film euphoria that engulfed the sector until 2012.

The major opportunity for laser tools, however, is coming from PERC cell production, both with new capacity being installed (both p-type mono and multi), and upgrades to existing p-type lines. Currently, most of the legacy p-type mono cell capacity has been upgraded to PERC, and the focus during 2018 and 2019 is moving p-type multi to be 100% PERC-compliant. This represents a massive driver for laser-based tools, in ablating contact openings in the passivated layers on the rear side of cells.

Laser tool supply has been met until now by system integrators InnoLas (Krailling, Germany) and 3D-Micromac, with lower volumes supplied by the former Rofin-Sinar Technologies systems business based in China (now absorbed within Coherent). The majority of supply though is coming from laser tool supplier Wuhan DR Laser Technology (Wuhan, China), with a further 5–6 Chinese tool suppliers also selling into the China PERC upgrade space.

What’s next for PV technology and laser tooling?

The solar PV industry has now moved firmly into a new phase of strong global growth that will propel annual deployment from 100 GW in 2017 to terawatt levels by 2030. Industry-leading manufacturers are now counting in-house capacities in the tens of gigawatts, with plans to continue growing production to match industry supply levels.

Solar cell efficiency is moving into the 20%-plus bracket as a standard offering, with advanced p-type structures and n-type architectures set to dominate production. Over the next couple of years, however, the PERC upgrade phase will dominate much of the process flow changes for mainstream p-type cell producers in China, sustaining healthy order intake levels for laser tool suppliers.

During 2019, it is expected that the next phase of technology upgrades will gain traction, either based upon full industry migration to bifacial p-type offerings, or seeing a stronger contribution from n-type production, including heterojunction-based solutions.

FINLAY COLVILLE ([email protected]) is head of research at PV-Tech & Solar Media, London, England; www.solarmedia.com.