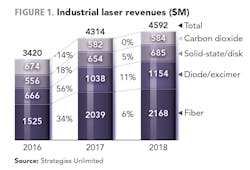

When 2017 started, I didn’t have an inkling that it would be a record year for industrial laser revenues—it turned out to be a 26% rise to slightly more than $4.3 billion (FIGURE 1). Coherent (Santa Clara, CA) reported fiscal 2017 bookings up to $2.03 billion and IPG Photonics (Oxford, MA) racked up a 25% increase year-over-year. Both went on to finish 2017 with record total revenues, with Coherent up 110% year-over-year and IPG Photonics up an anticipated 40% year-over-year (reporting in early 2018). And the third top laser manufacturer, TRUMPF (Ditzingen, Germany), finished their fiscal year in June 2017 with laser technology up 22.5% to $1.4 billion (total revenues up 10.8% to $4.5 billion).

The performance of these three industry leaders, with quarter after quarter of brilliant results, sent a message as I reviewed the numbers for this annual report. These companies led the 2017 market to new heights, pulling the rest of the supplier industry with it to an estimated (confirmation expected early in 2018) 26.1% increase in revenues.

What drove these sterling results in a year fraught with bad news from the social, cultural, and political sectors with terrorist actions around the globe, mass shootings of innocent civilians, continuing war in the Middle East, record-breaking bad weather in the USA, cyber-attacks on financial paragons, and unceasing messages out of Washington that seemed to further solidify the politically divided U.S., all of which saturated our senses to the extent that going to work was a forgotten pleasure.

Laser market overview

Sparking the excellent revenue growth in TABLE 1 were three factors: fiber laser revenues cracked the $2 billion level, turning in a 34% increase over 2016; solid-state/disk lasers rose 18% above a stagnant growth pattern pushed by strong high-power disk laser sales; and high-power diode and excimer lasers sales spurted to 56% growth, with the latter riding on the smartphone display application. The only loser was carbon-dioxide (CO2) lasers dropping 14%, as high-power units sold for sheet metal cutting took a hit from the increasingly popular, equivalent-power fiber lasers.

The revenue growth of high-power fiber lasers, used heavily in sheet metal cutting, lifted this laser technology to 47% of total industrial laser sales in 2017. Couple this with laser metal cutting representing 35% of all laser revenues, and it becomes obvious why laser metal cutting, a key component in the fabricated metal product sector of manufacturing used throughout the world, is a metric in a country’s gross domestic product (GDP). And in 2017, the average GDP was expected to grow to 3.6%. Further, the single largest laser market—China (~30%), slowing down to a more modest 6.8% GDP—is still the largest market for high-power fiber lasers used for sheet metal cutting.

TABLE 1 summarizes a three-year snapshot of the global industrial laser market. As is our practice, 2016 numbers have been revised to reflect the final-quarter changes reported by companies (see sidebar). The values for 2017 all show significant high growth except for CO2 lasers, down 14%—which, at the high-power level (≥1 kW), took a hit from the increased popularity of fiber lasers, specifically in the metal cutting sector. For applications such as engraving, lower-power CO2 lasers held their own.

Fiber laser sales grew 34% on the strength of an active sheet metal cutting market—particularly in Asia, and specifically in China. Higher growth rates in the welding sector also added to the increase in fiber laser revenues. This year, as a result of decreasing CO2sales, the solid-state category has been expanded to include high-power disk lasers, which at the high-power level contributed to the 18% growth experienced. Also making a significant contribution were strong sales of high-power diode lasers and the anticipated large deliveries of high-power excimer lasers used in fabricating OLED displays for smartphones.

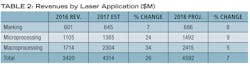

ILS divides the industrial laser markets into three segments seen in TABLE 2—Marking, Micromaterials (power <1 kW), and Macromaterials (power ≥1 kW). By far, the largest segment is Macro with 53% of total laser revenues, followed by Micro in 2017 with 32% of the total and Marking at 15%.

Marking, which grew 7%, includes engraving in the large low-power CO2 laser market that has historically experienced solid single-digit revenue growth, with tens of thousands of low selling-price units installed each year (FIGURE 1). Two factors mitigated against dramatic percentage increases: ruthless unit selling price wars in Asia—primarily China—by too many system suppliers, and the strong growth of other more dynamic segments stultifying percentage gains.

Micromaterials shows strong 24% revenue gain in 2017, thanks to the OLED annealing application for a new smartphone, which has placed a spike into revenue growth that will taper down in 2018 as systems deliveries near completion. A different picture is the Macro segment, which hit a high 34% as global manufacturing strength, led by the aforementioned spurt in sheet metal cutting system sales that some observers peg as high as 10,000 high-power units, had a record year.

Market details

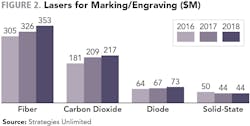

Marking/engraving. Laser marking and engraving, employing tens of thousands of low-power industrial lasers, has for decades been a solid yearly growth market, with recent year growth being tied to new applications in unique identification (UID) marking, 2D data matrix codes, security (ID cards), and countless other coding, serializing, and traceability applications. It’s safe to say that laser marking has opportunities in new and major markets for all types of lasers, such as newly developing, more affordable UV lasers that enable marking of materials too difficult for conventional lasers.

As shown in FIGURE 2, fiber lasers still hold an edge in marking revenues, with 50% of the 2017 market. Two years ago, fiber laser suppliers to the marking industries in Asia, and specifically in China, precipitated a price war that boosted laser sales volumes and reduced supplier profit margins. Now, at last count, more than 225 companies worldwide offer laser marking equipment.

Engraving, both deep mode using pulsed fiber lasers (marking serial numbers on automobile VIN plates) and surface disruption mode (think denim jeans showing fake creases), was mostly accomplished with low-cost, tube-type CO2lasers, which in Asia creates a massive market for replacement tubes (in the tens of thousands annually).

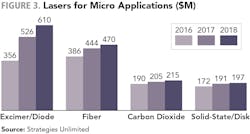

At a steady single-digit growth pattern (7% in 2017), laser marking/engraving continues to contribute about 15% annually to total industrial laser revenues.The Microprocessing sector began its steep growth curve when deliveries of excimer lasers for smartphone applications began. The delivery schedule for systems utilizing these lasers ramped up in 2017, so revenues for these lasers showed a 48% increase and represented 39% of total sales in the Microprocessing category.

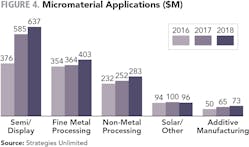

Fiber lasers in this <500 W category expanded by 15% as developing applications in micro-drilling and welding, as well as surface treatment, became serial production operations. Solid-state/disk lasers were also involved in many of these applications, and revenues grew at a strong 11% aided by increasing markets for ultrashort-pulse lasers. Low-power CO2laser sales, boosted by strength in the micro-via drilling sector with more than 700 systems delivered in Asia, grew 8% in revenues in 2017.In FIGURE 4, a 56% growth in the Semi/PC Board Display sub-category is mainly attributed to the smartphone display business as system deliveries peaked in 2017.

On a much smaller scale, lasers for applications in non-metal processing, including paper perforating and cutting, plastic drilling/cutting/joining, and hole drilling in medical devices, benefited from a climb in revenues (9%).

In the Metals sector, microprocessing revenues grew as low-power fiber, CO2, and disk laser sales for thin-section foil cutting and the beginnings of a long-awaited fine blanking market for mid-power fiber lasers encouraged supplier optimism. The anticipated revenue fallout from the manufacturing evolution in laser additive manufacturing occurred in 2017, but its effect on laser revenues split as major industry users, such as Siemens, Airbus, and GE, expanded their use of the laser for serial production in 2017. GE became the largest user, and is now also a supplier through acquisition of direct laser metal sintering technology. In this market, parts made by additive manufacturing changed to a serial production mode, demanding laser systems using higher laser power to increase productivity. Therefore, revenues in the additive manufacturing category have been split between Micro and Macro.

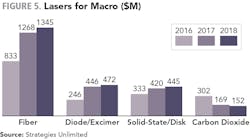

Macroprocessing. At a 53% share, revenues from Macroprocessing dominate the total revenues for all industrial lasers sold in 2017 because the more-than 21,000 units with output powers ≥1 kW tend to carry a high selling price and generate big revenues. This analysis (FIGURE 5) tracks all applications that require 1 kW or more for successful processing. In 2017, fiber lasers with output powers from 500 W to >10 kW grew 52% over 2016, accounting for 55% of all industrial lasers sold for Macroprocessing. Where once fiber laser growth came mostly at the expense of other high-power lasers, namely CO2, in 2017, fiber growth became organic as suppliers created, sustained, or developed new markets. As a consequence, high-power CO2 lasers, the long-time sector leader in unit sales, has been relegated after a 44% decrease over 2016 sales to a distant fourth, with only 7% of total Macro revenues.This year, the Solid-State category includes the substantial growth in revenues (21%) for high-power disk lasers used for cutting/welding operations. As a result, this sector gained 26% on 2016 sales and now represents about 18% of Macro laser revenues and 10% of all industrial laser sales.

In 2017, the ubiquitous Other category gained a face as Diode/Excimer because high-power direct-diode and excimer lasers found major revenue gains in welding/brazing and annealing. Business for these two was so good that in 2017, they vaulted, by virtue of a combined 81% growth, to number 2 in Macroprocessing revenues.

Overall in 2017, Macroprocessing revenues grew more than 34% year-on-year as industrial laser applications in the category all showed stronger-than-usual revenue growth (FIGURE 5).

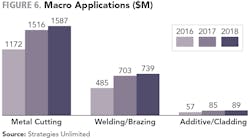

The impact of laser cutting of sheet metal components is apparent in FIGURE 6, where this application represents 63% of total Macro revenues in 2017. Sheet metal cutting with high-power lasers (primarily fiber) is also the largest industrial laser sector, with 35% of total revenues. Estimates of up to more than 10,000 units sold in 2017 seems reasonable. This application is the only global application for high-power lasers, used in almost every county in the world with advanced manufacturing capability. For 2017, revenues for metal cutting grew a spectacular 29%, which was reflected in the widespread global business upbeat for manufacturing.Also showing strong growth at a more-modest revenue level were welding/brazing, which had a 45% increase through activity in high-power disk and diode lasers, and cladding/additive manufacturing with a 50% revenue increase.

The future

At the end of 2017, the global mood in the manufacturing sector might be summed up as “taking a breath.” Surveying the industrial laser community after the extremely successful FABTECH tradeshow produced several comments about the multitude of orders taken for laser systems sold at the show. Quoting one harried product manager, “Best show bookings in years for our laser cutting equipment, but don’t know how we are going to meet the delivery schedules—a tough problem we usually are happy to have. But not this year, with business in the second half so good.”

Setting aside first-quarter 2018 delivery problems, Macro laser markets in 2018 are expected to return to a more normal pace—in the mid-single digits—after the overheated sales of laser cutting systems in 2017. Welding revenues will drop back to more-normal single digits now that the market has topped the $700 million level.

Additive manufacturing is more of a guess, as late 2017 activity at companies such as GE and Airbus suggests the modest 5% shown in FIGURE 6 is too pessimistic.

Micro revenues are expected to decline to about a 9% growth, a solid number once the bump from the OLED application cools down. Notice in FIGURE 4 that the expectations of developments in fine metal, non-metal, and additive manufacturing suggest an 11–13% increase, so Microprocessing might end up with a sold 9%+ gain in 2018.

Marking did not produce any trend changes in 2017 and the same mid-single digit growth is expected in 2018.

Overall, the total industrial laser material processing market is projected to rise about 7% in 2018.

The market forecasts in this report were created, with the assistance of Industrial Laser Solutions partner Strategies Unlimited, from public data released by public companies, other public data, direct contacts, and e-mail correspondence with industry companies. The numbers are based on data available up until the end of November 2017, with fourth-quarter data estimated from public companies’ guidance advice. These estimates will be updated online after fourth-quarter data becomes available in February 2018.