A year ago when compiling market data for the 2020 Annual Economic Review, the farthest thing from our mind was a complete global shutdown of the industrial laser market. What started in Wuhan (the Chinese home of industrial laser technology) then, like a snowball rolling downhill, spread through the manufacturing world, leaving shattered dreams of a forecasted growth year for this business. In case you’ve been living in a cave, I’m referring to the novel coronavirus (COVID-19).

Taking the pulse

For those unfamiliar with the process that Industrial Laser Solutions (ILS) uses to produce this annual review, our team starts collecting data and tapping industry contacts about two months before the publication date—for this issue, the process started, in earnest, in early November 2020. We needed to submit final copy for publication by the end of December. By then, we have reviewed the views of the global manufacturing industry to assess prospects for industrial laser system usage. We also review published comments from the companies manufacturing and supplying the laser products that will serve the market. Because of the timing of public company quarterly reports, we rely on their published guidance for last-quarter results, which typically are not available until February of the next year. Our experience is that this is usually very close to actual.

For 2020, we had the sense that the year would essentially be a copy of 2019, with growth either flat or minimal in the first half, followed by a stronger third quarter that would produce a year-end, low-single-digit revenue growth. This was predicated by laser activity in China, the largest single market for laser products, which was sensitive to the vagaries of an unpredictable U.S. President who would be working for reelection.

Before the ink was dry on the 2019/2020 Annual Economic Review, the China manufacturing market closed because the country, in response to the pandemic, shut down most nonessential businesses, hitting the industrial laser market on both the supply and end-user levels. As the virus spread globally, country after country emulated the Chinese model, some in Europe (except for Germany) completely and some like the United States partially, reflecting a country torn by political divisiveness refusing to act and leading to massive social disruption. Chinese laser product suppliers worked off the excess inventory that had built up as a slowing economy stultified new business.

By the time we (in the West) got our pandemic response act together, an effective Chinese COVID-19 reaction stalled further expansion of the virus and business returned to semblance of normality. The result was that China’s laser equipment industry commenced rebuilding machine inventory to meet an anticipated market demand by placing large orders for imported laser products. This had their global suppliers rushing to supply goods from government-approved semi-shutdown facilities. As a consequence, the 2020 first-half record bookings boosted revenues that offset predicted negative results. ILS’ basket of companies used to gauge the industrial laser market went from deep red to black, in some cases more so, in the third quarter when more than half were in the black. Members in the ILS Billion-Dollar Club (each with more than $1 billion in industrial laser-related product revenues) were split 50/50 on growth/loss.

As this report was drafted, global markets were widely chaotic as a resurge in COVID-19 hit. Manufacturing in the U.S. was booming, sustained by companies with mostly nonessential employees working from home in a virus response. China was in growth slowdown as Asian markets paused and the Western market, a sought-after target the government coveted in their latest five-year plan, was battling a pandemic resurgence.

Third-quarter reports from the ILS industrial laser, laser systems, and related products market showed that 13 companies had negative growth numbers from their last reports, which were also negative; five companies experienced positive growth (with two turning around previous quarter losses); and one company had flat revenues. The results were as expected—after all, most companies were impacted by COVID-19 related shutdowns. Three of the growth companies had revenues from Chinese companies. Several members of the ILS Billion-Dollar Club reporting losses experienced strong orders in the quarter, reducing the magnitude of the loss numbers. As this was written, a resurgence in COVID-19 reporting numbers may lead to resumed government shutdowns in some areas, although this is considered as a stop-gap measure if the expected vaccine distribution drags deeply into 2021.

ILS is impressed by the apparent health of the global manufacturing countries that, against the odds, are ramping up production. An example is the U.S., where 2020 was a good year.

Laser market in 2020

The 2020 laser market was a struggle, which was a common answer that ILS heard over and over as the fiscal quarters rolled by. The absence of tradeshows reduced the flow of market gossip, but enough anecdotal comments supported the published remarks of public company management, allowing us to expect the worst, but to be relieved when the year eked out a slim positive number.

This review was finalized for publication in late December 2020, so any financial information for the last quarter of calendar-year 2020 will not become public until early 2021. We work from corporate guidance estimates (usually given in a range—for example, $150,000–200,000). Over years of experience, we have maintained a ±2–3% error. Yes, every once in a while we have been surprised—2020 could be one of those years if an end-of-year holiday resurgence of the COVID-19 virus hits first-quarter 2021 manufacturing.

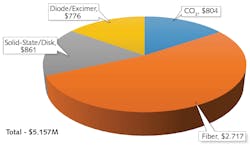

As shown in Figure 1, the revised total market for industrial lasers in 2019 came in 5% higher than we had projected, thanks to the beginning of a resurgent market in China in the fourth quarter, which resulted in only a -10% drop in revised 2019 numbers. Many of the published comments from other global laser company management focused on a reduction in negative growth as a positive in 2020.

Like many non-medical health product manufacturers, the impact of the COVID-19 pandemic was felt by most industrial laser product suppliers. For 2020, ILS expected revenues to increase only slightly over 2019 by a little more than 2%. All in all, not so bad for a turbulent year. Companies supplying fiber lasers again carried the day with a 4% increase over 2019 numbers.

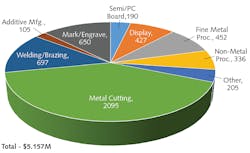

A majority of industrial fiber lasers are either exported into or produced in China. In 2020, fiber lasers generated more than 53% of total industrial revenues (see Fig. 2). Combine this factor with the blossoming China market, and you can appreciate the import of China and fiber lasers on the total laser market.In 2020, a significant contributor to total laser revenues (15%) were excimer lasers for annealing displays of mobile communication devices. Surprisingly, carbon dioxide (CO2) lasers at low power for marking/engraving had a good year (4%), as did kilowatt lasers for additive manufacturing and fine metal and non-metal processing, which generated 16% of laser revenues. Solid-state lasers, specifically kilowatt-level for metal cutting, made up another 17%.

Metal cutting applications, at 40% of total sales, continue to generate positive numbers, thanks in part to the increase in orders. For the first time in recent years, growth in the cutting market dropped to about 2% as the market paused when COVID-19 spread through advanced manufacturing countries. Systems with 10 kW or more fiber laser power and the attractiveness of beam output adjustment that enables real-time energy distribution changes for welding applications supported sales gains. Low-power sealed CO2 lasers at 3% and fiber lasers at 8% for marking/engraving showed significant gains.Marking/engraving applications (see Fig. 3) showed a contrary year in 2020 with almost a 6% revenue increase over 2019’s 6% loss. This picked up in mid-year 2020 when suppliers reported large orders from China as that country roared out of the COVID-19 shutdown to rebuild a depleted product inventory. CO2 laser sales also increased appreciably.Microprocessing applications gained 3% over 2019 (-18%) on strength in fine (8%) and non-metal (14%) processing, which tended to offset the scheduled drop (-5%) in excimer laser system sales for mobile displays. PC board drilling countered a cyclical slow year in semiconductor (-2%). Lasers for additive manufacturing, while minimal, had a strong year at 7%.

Macro-application sales, led by fiber lasers for sheet metal cutting, turned a -11% loss in 2019 to a 3% gain in 2020 on the rapid resurgence from the COVID-19 pandemic in China. Laser metal cutting, at 41%, is the bellwether application for high-power fiber lasers. So, with three of the ILS Billion-Dollar Club companies concentrating on this sector, we closely monitor this global application. Figure 2 clearly shows the import of fiber on total laser revenues.

There is no question that 2020 would have been another negative year had it not been for market conditions in China. Lasers for manufacturing in that market were slow early in the year, but they came back strongly as the year progressed. Chinese laser companies now make up an increasing amount of total market revenues; there are now Chinese companies making lasers for Chinese companies operating as OEMs that are now becoming visible in the global marketplace. Also, European and Japanese laser system manufacturers are investing in China in order to gain revenue share from the fast-growing global export market. (Editor’s note: An important review of the impact rising from China’s expansion into the international market for industrial laser products appeared in the Industrial Laser Solutions section of the January issue of Laser Focus World; see http://bit.ly/ILS-Jan2021).

Prospects for 2021 and beyond

As seen in Figure 1, a modest growth of nearly 5% is expected to get total laser revenues back near the $5.6 billion pre-COVID-19 levels. Again, fiber lasers at all power levels will be the driver with about 53% of market revenues. Metal cutting at 5% and fine metal processing at 11% are expected to be the prime movers to get revenues flowing again. Boosted applications in additive manufacturing will get high-power laser revenues up with strong double-digit movement. Deliveries into the OLED display market should turn around, leading to a very modest 2% growth in 2021. Prospects for significant revenues from the new market of microLEDs is farther out, even though the first units of a very large-screen microLED TV will appear in early 2021.

Three factors point toward the optimistic projection of industrial laser market growth in 2021. First is the anticipated success of the COVID-19 vaccination program that commenced at the end of 2020. The ambitious goal of inoculating most of the world’s population to slow or eradicate this virus could be a drag on the return to growth in the world manufacturing sector, but early evidence of success is encouraging, as first-quarter 2021 deliveries of substantial last-quarter 2020 orders extrapolates into a solid year of single-digit growth.

Secondly, in this business climate, China can build on growing markets, as this country’s industrial laser products continue its early successes of 2020 and build market share for export sales.

And thirdly, the global market for lasers for manufacturing operations has continued to expand, even when interruptions like the COVID-19 pandemic interfered. Since the business of industrial laser material processing commenced in 1970, this industry has experienced a 17% compound annual growth rate (CAGR), and in periods where interruptions reversed growth, the expanding markets returned to growth quickly.

As this report was being finalized for publication, word of a mutant strain of the COVID-19 virus leaked out from the UK, spreading new fears even as global distribution of several vaccines was ramping up. If a new variant of the COVID-19 virus spreads globally and if this mutation is not checked by existing vaccines, we might experience a new round of economic disruption—the consequences of which could cause all market projections to be negated.